Entry for Manufacturing Overhead Cost Applied to Jobs.

As shown on the timesheet in Figure 24 Timesheet for Custom Furniture Company Tim Wallace charged six hours to job 50. Note that the job cost sheet in the example below indicates that 27 labor hours have been worked.

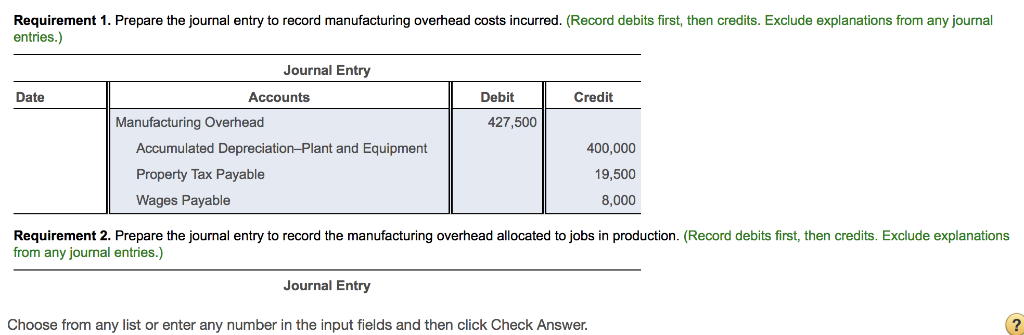

Solved Requirement 1 Prepare The Journal Entry To Record Chegg Com

If the job in work in process has recorded actual material costs of 4640 for the accounting period then the predetermined overhead applied to the job is calculated as follows.

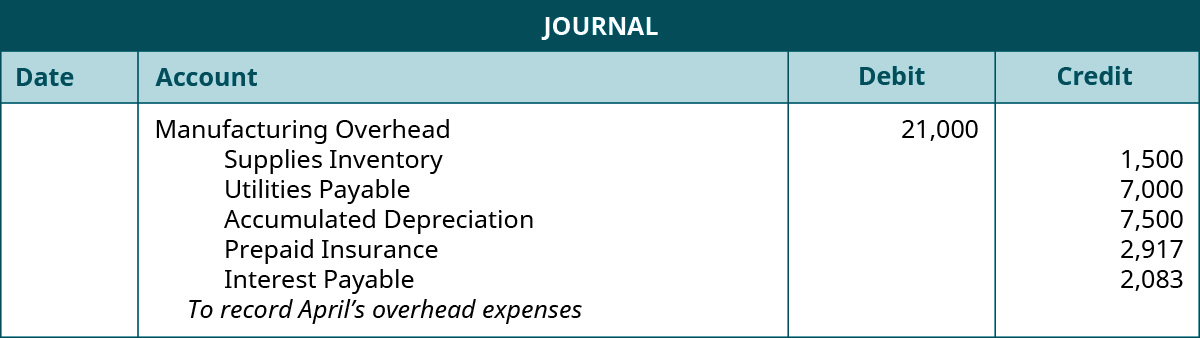

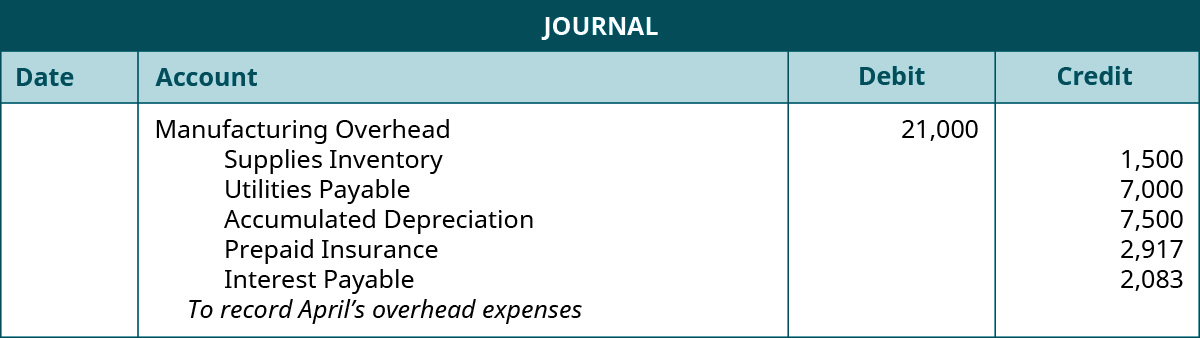

. View the full answer. When overhead is over-applied. As shown in manufacturing overhead costs of 21000 were incurred.

The journal entry to apply manufacturing overhead costs to completed jobs credits either Applied. Because manufacturing overhead is applied at a rate of. The information about manufacturing overhead cost applied.

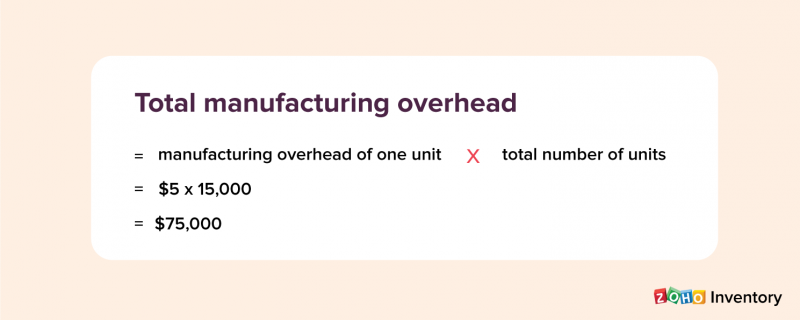

The overhead rate is determined as follows. The 20000 machining job ends up taking 250 direct labor hours which is multiplied by the overhead rate of 5 to come up with 1250 of applied overhead costs. The manufacturing overhead cost would be applied to this job as follows.

The journal entry to apply manufacturing overhead costs to completed jobs credits either Applied Manufacturing Overhead or Manufacturing Overhead Control. The company uses a job-order costing system that applies manufacturing overhead cost to jobs on the basis of direct labor- hours. A companys Individual job sheets show these costs.

Accounts Receivable 1000000 Sales Revenue 1000000 Cost of Goods Sold 600000 Finished Goods 600000 Part II Worth 26 points Baba Company is a manufacturing firm that uses job. The entry to record these expenses increases the amount of. Overhead is applied at 125 times the direct labor cost.

Therefore the journal entry to record the applied manufacturing overhead is. The journal entry to apply manufacturing overhead costs to completed jobs credits either Applied Manufacturing Overhead or Manufacturing Overhead Control. Stickles Corporation incurred 79000 of actual Manufacturing Overhead costs during August.

Applied overheads are the indirect cost that is directly linked to the production of goods but cannot be charged specifically to any of the cost objects. Therefore a total of 216 of manufacturing overhead cost would be applied to the job. Dinosaur Vinyl also records the actual overhead incurred.

Asked Sep 19 2019 in Business. The journal entry to apply. The predetermined overhead rate computed at the beginning of the year is 8 per direct labor hour.

However the manufacturing overhead costs that it has applied to the production based on the predetermined standard rate is 10000 for the period. We review their content and use your feedback to keep the quality high. During the same period the Manufacturing Overhead applied to Work in Process was 75000.

During the year manufacturing overhead is applied to jobs in work-in-process using the following formula. Answer --The statement is FALSE. Use the data on the cost sheets to perform these tasks.

At the end of the. Assume that the applied manufacturing overhead column of the job cost sheets show a total of P540000. The journal entry to apply manufacturing overhead costs to completed.

In the journal entry to close. Overhead applied Pre-determined overhead rate X. If a company incurs 2000 of factory rent 1000 of factory utilities and 5000 of miscellaneous factory costs the journal entry to record these transactions would be to debit ______.

Overhead rate Manufacturing overhead Labor hours Overhead rate 324000 36000 900 per labor hour. When overhead is under-applied. Such overhead cost is charged or.

Need help with J Southworth Company uses a job-order costing system and applies manufacturing overhead cost to jobs on the basis of the cost of direct materials used. The following entry is made for this purpose. In this case the manufacturing.

Its predetermined overhead rate was.

Xiaoqian Chen This Picture Describes The Job Order Cost Flow Process That Related To Chapter 17 The Job Order Costing System I Think It Helps Us To Easier Un

Solved The Following Information Applies To The Questions Chegg Com

Manufacturing Overhead Moh Cost How To Calculate Moh Cost

Prepare Journal Entries For A Job Order Cost System Principles Of Accounting Volume 2 Managerial Accounting

Comments

Post a Comment